Africa set to be the next big mobile market according to Jumia Mobile Report for Africa – Africa is judiciously positioned to be the next big mobile market, enviously eyed by global investors for her enormous growth opportunities.

Nevertheless, the growth of mobile will remain uneven, as the 54 African countries record varying performances, both in their respective mobile markets and the entire economies.

According to Jumia Mobile Report for Africa – Africa is judgmentally positioned as the next big mobile market, envied by global investors for its enormous growth opportunities.

To take advantage of this monetary opportunity, 2019 is undeniably the year to prioritize investments in Africa’s mobile market.

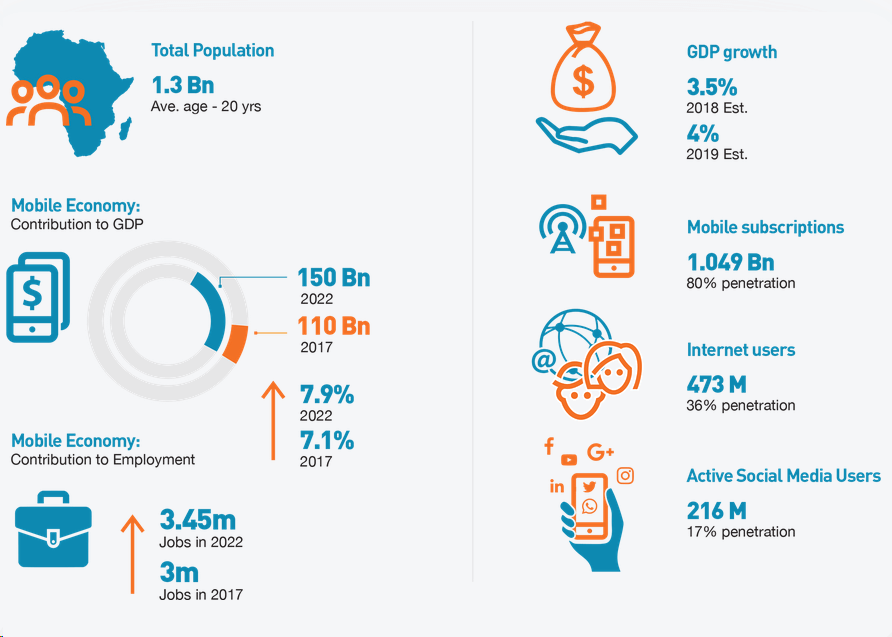

According to a Mobile Report for Africa released by Jumia, Africa’s leading e – commerce platform, real output growth on the continent is expected to reach 4.1 percent by the end of 2019 ; from an estimated 3.5 percent in 2018.

Growth is expected as a result of the continent’s improvement in macroeconomic conditions.

The Mobile Economy contributed $ 110 billion (7 percent of total GDP) to Africa’s GDP in 2017 and is expected to generate more than $ 150 billion (about 7.9 percent of GDP) by 2022.

In 2017, the mobile technology and services industry further supported 3 million jobs.

A growing population of 1.28 billion people (42 percent of whom are in cities), a snowballing middle class expected to reach 1.1 billion out of the 2.5 billion Africans by 2050 — leading to higher purchasing power — are among the considerations for the mobile explosion in Africa.

Other factors that have driven much of Africa’s growth in mobile subscriptions include more affordable smartphones, declining mobile data plans, smartphone efficiency, including online shopping / purchasing, mobile payments, and information search.

Nevertheless, mobile growth will remain uneven as the 54 African countries record varying performance in both their respective mobile markets and the entire economies.

Booming number of smartphones in Africa according to Jumia Mobile Report for Africa

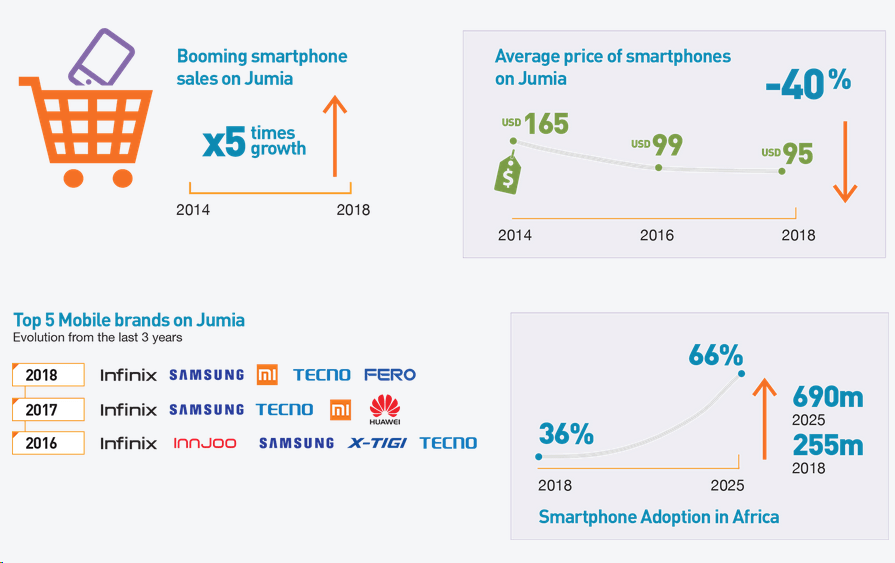

In 2018, Africa had 255 million smartphone connections, which is equivalent to 36% of the total population.

This is against a 444 million mobile subscriber base in the continent by 2017.

Although smartphone affordability has been cited as a major challenge for part of the population, Jumia – Africa’s leading e – commerce platform – has reported a decreasing average smartphone prices over the past three years.

By 2025, there are expected to be approximately 690 million smartphones in Sub-Saharan Africa, equating to a connection of about 66%.

The average amount spent on buying a smartphone on the platform in 2016 was USD 99, which dropped to USD 96 in 2017 and USD 95 in 2018 respectively.

However, the rise of affordable entry – level devices from price – focused brands remains a key driver of smartphone adoption in Africa.

Among Jumia’s top mobile brands in 2018 were Infinix (which has been the top brand for the past three years), Samsung, Xiaomi, Tecno, and Fero.

Furthermore, while mobile data affordability in Africa is improving across the board, the cost remains high, with a price of 1 GB averaging around 8.76 percent compared to the 2017 monthly income.

Sub – Saharan Africa is experiencing a high rate of migration to mobile broadband connections, with 5 G connections expected to be launched in Africa in 2021.

In 2018, 4 G stood at 6%, 3 G at 35%, while 2 G dominated at 59%.

By 2025, 5G will account for 3% of the total connections, while 4G will rise to 24%. 3G will be dominant at 59%, and 2G will have dropped to just 14% of the total connections.